What can I say when the economy should have come crashing down by now it seems to constantly be propped back up. Now the united states isn't in that bad of a spot and there's enough smart people to figure this out. So if you thought our roughly 3% - 4% was still bad you should see the rest of the world.

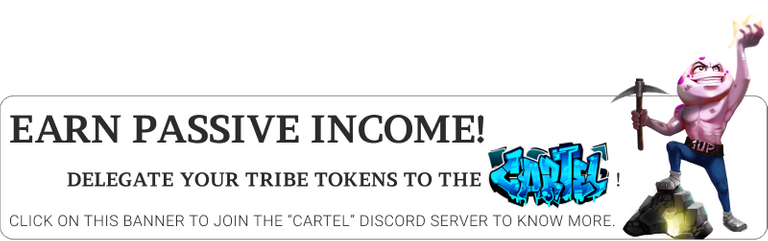

For example this is how the world looked in 2022 when inflation was at an all time high in the USA (at least in the last few years)

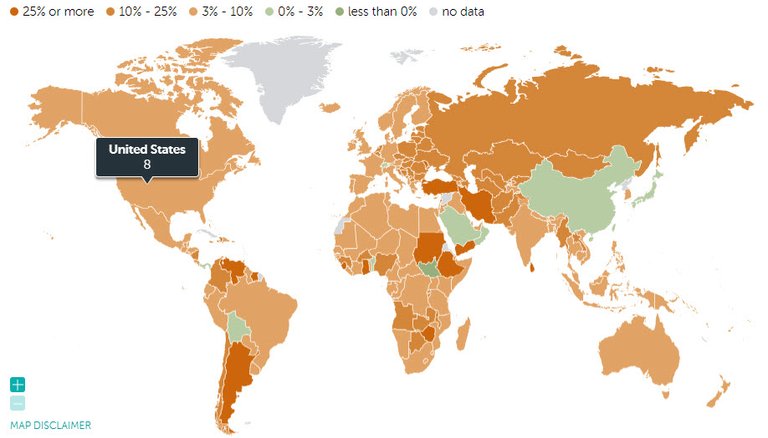

to roughly today and forecasted to end of the year...

Now while there's going to be for sure some data missing from any map we can see that a lot of countries should be coming out of record high inflation and start to calm down. These maps were pulled from IMF.org. If we zoom out to 2028 is when we start to see prices become more stabilized around the world.

Also it's pretty wild when you look into things about the 2% target and realize just how pointless it really is and how it all got started.

The CPI

The CPI report has shown us again that inflation just kind of seems to be hanging around the 3.2% mark since Jun of last year. Meaning that high rate the fed currently has really isn't doing much of anything anymore it's just kind of holding things.

When you break this down further you can see that energy continues to rise, food still remains high and transportation services also increasing.

But if you pull up the core data which doesn't include things like food, energy and homes (which are all things you pretty much need to live lol) you get a increase of 0.4% month over month. Thus showing us inflation is starting to come back already which means I personally don't see a rate cut happening any time soon. Those three rate changes the big mans been talking about might and it's a big might come in late 2024 maybe even after the election season is over.

The stock market and crypto during all of this has been roaring for some really weird reason. That reason is primarily fueled by the AI race right now and I would even throw in quantum computing. There's A LOT of money being thrown around in this sector especially now that the worlds nearly divided in half and a full scale world war is going on with Ukraine as the front.

Those stock currently fueling a lot of the growth right now are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. All primarily AI and new age focused in some manner.

This worries people we are in for a repeat of the .com bubble or another bubble because the stock market is so heavily focused on AI.

But are we really???

When you look at everything AI still has to do and the increasing demand for it WORLD WIDE and no shortage of new tech coming out for it it's pretty clear we have a very very long way to still go in the AI era and yes I would consider it an era of which has just started.

Crypto

Crypto has spiked over the last year dwarfing the gains made in the stock market once again. However as of today Bitcoin has a max high of around $67,000 and we are right now seeing it tumble from those highs. It's expect that bitcoin could see a major sell off leading into the halving and not really get a recovery boom until early to late summer when institutional investing actully does happen.

Now personally I feel like we could see bitcoin return to around 50k levels if not a bit lower before we get a new bull run and it's almost like a repeat of what we saw with the last bull run.

A big part of the issue with bitcoin right now is liqudity issues and Ethereum is in that same boat. Bitcoin is about to go through a halving event meaning the new supply is yet again going to be cut in half and there's only so much bitcoin to go around. These ETFs need that bitcoin in order to function so if they can't get their hands on it well...

There are also negatives to buying Bitcoin with your 401k money aka ETFs in that you don't actully own the bitcoin yourself it's held with the company you are trading through. You can't use the bitcoin and there's also a pretty high fee charged that runs around 0.21% which might not seem like a lot but if you dig into the world of money you quickly see just how many any little fee like this is absolutely destroying your earning capabilities.

Currently ETFs are buying up around 3,500 BTC per day of the 900 being printed each day which is soon to become just 450 per day. Now when you throw in my last write up here: Is Institutional Investing Even Happening? I pointed out that large investors are simply not buying into bitcoin yet and it's still mainly all retail investors. That's because clearing houses have yet to figure things out and expect another 2-6 months more from today until they are ready.

This is causing speculation of a saddening and deepening correction on bitcoin over the next 1-3 months before we start to see it climb again. But that climb many expect could very well be around the ball park of $150,000 by end of year and even higher in 2025.

What are you thoughts on the markets today and if new ATH are still inbound for end of 2024 and 2025.

Posted Using InLeo Alpha