First of all I would like to explain why I make a post about the Shadow Exchange. I have been discovering the Sonic Blockchain lately and on this blockchain there is one app that trumps all the others: The Shadow Exchange. For two days, I have tried to understand how this Defi platform works and I couldn't find any specific tutorial other than the documentation of the platform itself. I made some great mistakes and I believe it's worth to make a post about it. Just for the sake of you having some fun reading about my troubles :-).

Why this exchange?

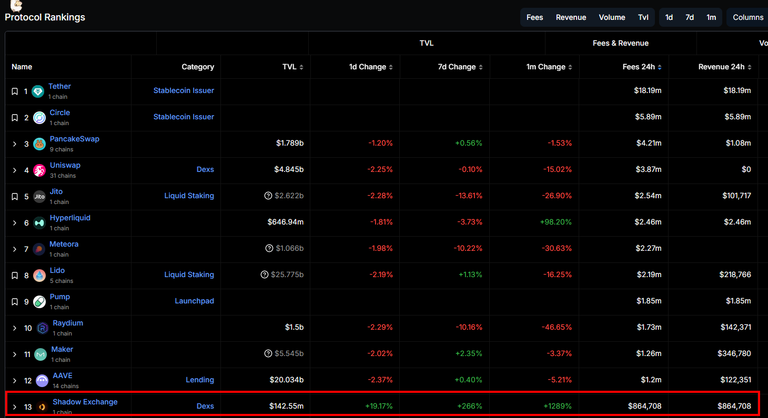

You probably wonder why I was dealing with this exchange in the first place. When you go to Defilama and analyze the different protocols, you find the Shadow exchange in 13th position in terms of generated fees in front of protocols like Jupiter or Orca. The TVL increase in the last month has been of 1289%. For a protocol that is on a relatively new blockchain this intrigued me a lot. So I was trying to find tutorials and explanations and came up quite short. When this happens, I tend to define a small budget for exploration. That's what I did in this case. I took about 30$ from binance and started to play...

source: https://defillama.com/

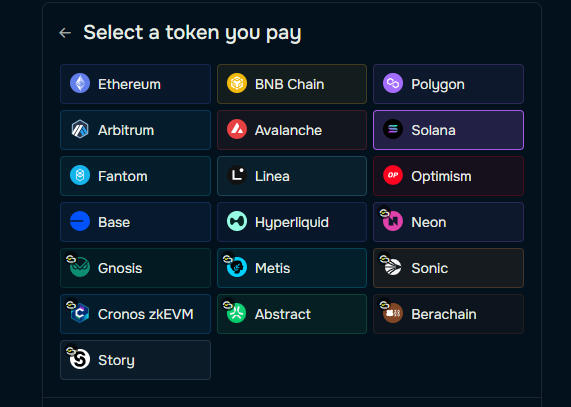

In the meantime, I found a way how it is possible to bring tokens to Sonic in a decentralized way that I would like to share it here with you.

How to get funds to the Sonic blockchain?

By far the easiest way to bring tokens to Sonic is by using deBridge. DeBridge links 19 blockchains together. Among them Ethereum, BNB, Polygon, Arbitrum, Avalanche, Solana and Sonic. You can use Metamask or Phantom to create a Sonic wallet and easily transfer tokens to it. You will need the S token for gas fees. The gas fees are quite affordable but by far not free. A transaction costs in general a little less than 0.01$.

All the blockchains linked by deBridge

How does the Shadow Exchange work and what makes it special?

To be honest, I had to do a lot of testing and errors to actually understand how things are working on this Exchange. The more I researched, the more I started to understand why this protocal was a bit different than most Defi platforms.

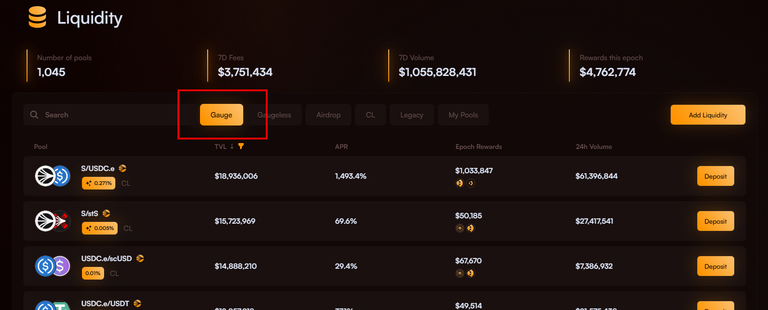

At first sight, the platform is very similar to other defi protocols. It has a swap function to swap Sonic based tokens. Then there are the liquidity pools. There are 1040 pools at the moment where you can provide liquidity. But this is not all of it. To understand the exchange more in depth, I suggest you go go on reading...

My (long) path to enlightenment

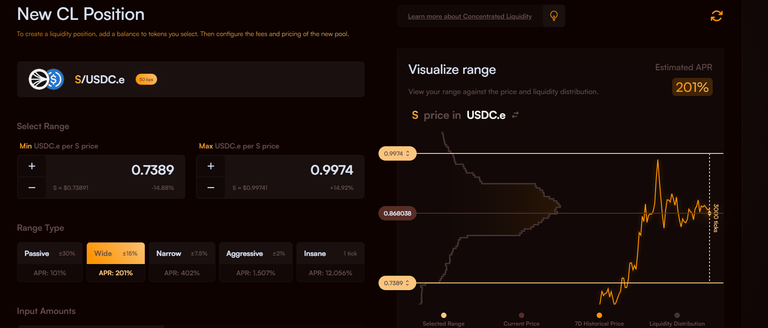

Once I had some S tokens sent in from Binance, I started to provide liquidity to a pool S/USDC.e. It's the pool with the move volume, the biggest TVL and at the same time a quite high APR.

You have preset ranges that you can chose from. The smaller the range, the higher the APR and the higher the risk of impermanent loss. Since I only invested about 30 $, I chose an average range so that it would be worth it.

The funny thing is that I expected to get rewards in S and USDC but instead I got rewards in Shadow and xShadow tokens. I was wondering if there was an issue with the website and even wrote something in their discord... People kind of made fun of me because without realizing it, I provided liquidity in a pool that is 'Gauged'. I had to look it up in their docs and it's a pool whose rewards are paid in Shadow and xShadow tokens.

Shadow tokens, xShadow tokens, x33 tokens... what the heck!

Bugger, now I had to some xShadow tokens, I had to try to understand what they are and I went to the docs. I probably didn't read the correct section because I really didn't get it and was not wiser than before.

I tried to find a way to swap my xShadow tokens but there was no way to do it. However, I could sell my Shadow tokens.

I went to their discord into the general discussion forum to try to get an idea of what this xShadow token is. Now, I saw people speaking about a juicy rebase and x33 tokens? Instead of getting answers, I had more and more questions.

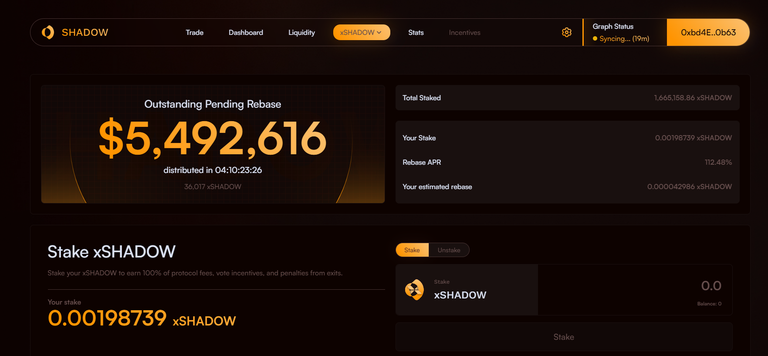

I went to the xShadow tab on the website and there there is this big rebase with almost 5 millions of pending rebase that would be distributed in 4 hours! I figured out that you actually needed to stake the xShadow token to get a part of this huge pie. This rebase is formed by people who unstake xShadow. They have the option to either wait for a long time period to get 100% of their tokens liquid or they can do it immediately and pay a penalty that fills this rebase.

I had about 0.3$ worth of xShadow and of course I staked them immediately. It cost me about 30% of the amount just in fees to do it but hey, I don't want to miss this rebase payment in 4 hours!

Moving too fast is not that good...

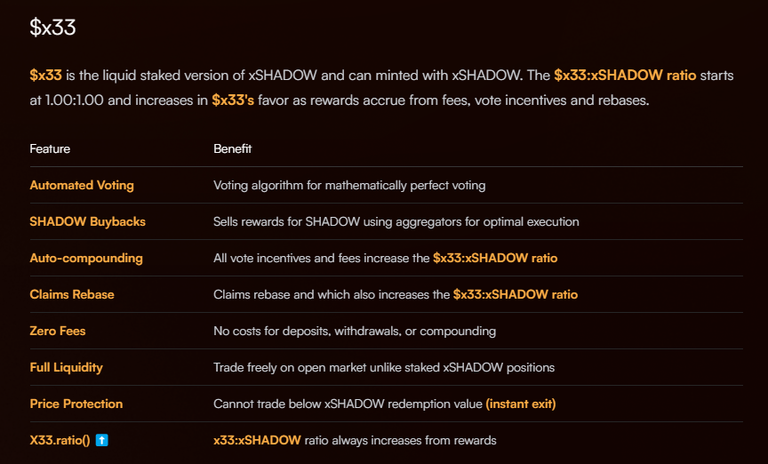

Then I scrolled down a little bit and I found out that I could actually do liquid staking... Instead of staking xShadow and blocking it for a long time, I could have just transformed it into x33 which is the liquid stake of xShadow and which can be traded.

I then saw that x33 was actually doing all I had been doing without fees. I would get the rebates and it would compound everything into the token. That would have been the better option for such a small position and I could sell it. It also said stuff about voting on things... What votes?

Voting?

Under the xShadow tab, you actually have a voting menu and you need to vote for a pool and then you will get rewards in the form of what I expected from the beginning, namely S and USDC.e tokens. So there you go, another fee to vote for that pool and hopefully I will get some rewards with this small amount.

After that, I thought I had done everything necessary to profit from the big rebase and went to bed.

Almost 50 years old and not capable of differentiating hours from days...

This morning, I got up and was surprised that I didn't get any rebase to claim. What happened? What did I do wrong? I saw that there was another rebase in 4 hours. Let's do things well for this one. I went back to discord and asked around and again had some fun comments. I actually read the whole thing wrongly, the rebase was not in 4 hours but in 4 bloody days! I stressed and acted stupidly because of this mistake. Well done... At least I still have some time now :-)

How are the tokenomics?

Running after the big pot made me do things without much thinking. That's the main reason why I never do such things with more money. The fact is that I learned a lot and I tried to understand how this whole concept was working.

There is a maximum supply of 10'000'000 Shadow tokens. It's possible to convert each Shadow token at any time into xShadow tokens.

According to Coingecko, there is a total supply at the moment of 3,212 million tokens but only 229'705 are circulating. 2.9 million of tokens are in the form of xShadow tokens that can't be traded. There are about 361'000 x33 tokens in circulation.

When you provide liquidity for a gauged pool, you will get the rewards in xShadow allocated to the pool in accordance to the voting of the community. This means that liquidity provider will get xShadow tokens as reward. The real fees of the pools, will actually go to the people who vote for the pools.

What is interesting is that if people are doing liquid staking with x33, then there is an algorithm that actually uses these rewards to buy Shadow tokens and compounds them to increase the value of the x33 token.

We have therefore a situation that has very few tokens in circulation and a very high staking rate. We have organic buy pressure from liquid staking and real use case for the token with voting rewards and rebase rewards. The result is quite impressive in price evolution of the token so far.

source: Coingecko

Of course this evolution is pushed by the high influx of funds at the moment and also by the relatively low TVL which gives huge APR numbers to investors.

Combined with the fact that investing on Shadow exchange also gives you points for the Sonic airdrop adds quite an incentive for this project.

It's however I young project and whenever in such cases it's important to keep the risks in perspective. DYR before you invest anything into it.

If you read until here I congratulate you :-). This got a bit longer than expected...

With @ph1102, I'm running the @liotes project.

Please consider supporting our Witness nodes:

-

-