Big numbers means lots of hype and that's exactly what we have been getting not only from the world of crypto lately with $BTC breaking 50k but also the stock market. Today I want to take a step away from constant crypto posts and talk a bit about the stock market.

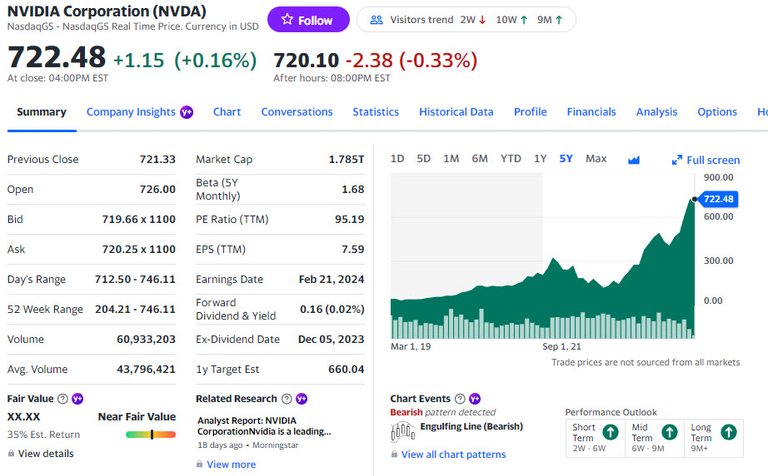

Nvidia now has a larger market cap than all of China stock market. Just take a look at this crazy thing.

This is a monster of a stock and 4 years ago I told others it was most likely a solid investment because of the amount of demand for their GPUs for Crypto mining. Once the markets came down though and Ethereum launched news of becoming a proof of stake token we saw the stock start to come down some. Fast forward to today and Nvidia found it's next cash cow and that's AI.

Now it's unclear on how fast and far AI will go. On one end it seems pretty advanced already and that could be tapping out the demand for the stock already. However there's the flip side of that where AI might only just be getting started and powerful chips that run this AI might very well only be getting started as well.

There other things you need to connect the dots with is how its sourced. A lot of these chips use what is called rare earth metals and other countries such as China and Taiwan hold treasure troves of it. It's when Taiwan is so projected from China by the USA and Japan and other countries in that area. China has also issued a ban of exporting these rare earths to the USA as a way to start standing up for themselves. However just recently it was found that there are larger pockets of rare earths right here in the USA. However IMO you should always suck every other country dry of their minerals before you start tapping into yours ;) ;).

New All Time Highs

As of yesterday we saw an all time hive in the S&P 500 and a number of companies now being worth over a trillion dollars. In fact Microsoft now comes in as the largest in the world with a 3 trillion dollar market. That's almost double the size of all of crypto by just one company. Kind of shows you how much investment money is out there that could still fall into cryptos lap now.

Don't underestimate FOMO and news. This is a lesson I've learned over the years. When the stock market hits all time highs many people start catching it in the news and investing at the peak. While that sounds like a bad idea it's actully been proven that over time investing during the first day or days of an all time high has actully yielded better results. Now this applies mainly towards a broad index fund such as the S&P 500 and not so much a single stock.

The reason this happens is as people see videos, news etc all talking about it a lot of people have FOMO and end up investing which further drives up the price of the market. It still blows my mind to this day but if you can keep your emotions in check you can actully do rather well in the stock market based on understanding what a vast majority of other people will do on emotion. We are emotional creatures.

Inflation

Inflation numbers have come in again which is normally the center point for the stock market. While one is coming in a 3.1% down from 3.4% which should be positive news those who take a real look at things have actully seen inflation rise. That's because the one the government talks about all the time leaves out things like gas, shelter and food as they consider them must haves and shouldn't be factored in. Yeah, tell me how that makes sense lol

That 3.1% however is still above the 2% target which means the feds will not be changing rates. At the current rate this inflation number is falling we might not see the first small 0.25% reduction until July of 2024. Yep another at least 5 months away but more like 6 months away before we start to see a reduction in the fed rate.

In terms of other inflation rates such as auto, housing, food and energy have actully increased at a more rapid rate then before. Many coming in 0.3% and up. That means at those current rates your real inflation number for 2024 is currently predicted at 3.6% and higher still way off the target zone.

Elections

Yep, this is the year of elections of which causes a huge mess of things. Data shows us that the stock market normally always goes up during an election year. Now of course this is just stats and there's a million and one factors that go into it all. so it goes without saying this article is for entertainment purposes only and is not financial advice. Do your own research before investing.

Posted Using InLeo Alpha